What's the most you can borrow for a mortgage

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements.

Mortgage Calculator How Much Can I Borrow Nerdwallet

Compare up to 5 free offers now.

. When you apply for a mortgage the amount youll be allowed to borrow will be capped at a multiple of your household income. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Broadly speaking most lenders will allow you. Ad Compare Lowest Home Loan Lender Rates Today in 2022.

Can be combined with monthly payout. Fill in the entry fields and click on the View Report button to see a. The maximum you could borrow from most lenders is around.

Apply Easily And Get Pre Approved In 24hrs. For the most vulnerable borrowers the effects of debt are even more crushing. To determine the most you can borrow for a VA loan the mortgage lender may use a specific DTI cutoff or threshold.

Now is the Time to Take Action and Lock your Rate. Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Find A Lender That Offers Great Service.

Backed by the Federal Housing Administration FHA loans require only 35 down and a. The maximum amount you can borrow with an FHA-insured. Show me how it works.

Ad Were Americas 1 Online Lender. Its generally not recommended to borrow more than you can comfortably afford because you dont want to overstretch yourself and struggle to meet your repayments. Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage.

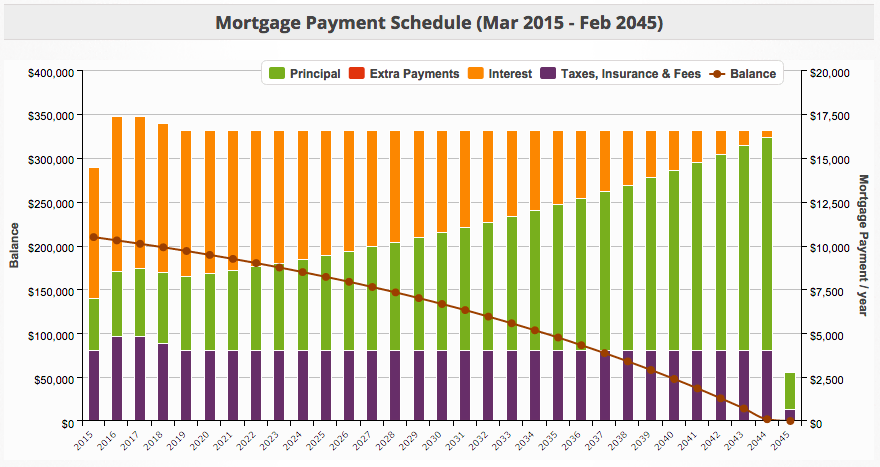

Whatever you dont use in your credit line will keep growing allowing you to borrow up to a maximum amount stated in your mortgage. Find out more about the fees you may need to pay. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income.

Nearly one-third of borrowers have debt but no degree according to an analysis by the. 2 x 30k salary 60000. Compare More Than Just Rates.

To be able to get a mortgage of 100000. You typically need a minimum deposit of 5 to get a mortgage. They can also handle it on a case-by-case basis allowing more debt for.

Generally speaking you may have trouble finding a mortgage below about 60000 unless youre searching for a specific unconventional loan type more on that below. Lock Your Rate Now With Quicken Loans. Lowest Home Loan Rates Compared Reviewed.

LendingTree helps simplify financial decisions through choice education and support. Apply Today Enjoy Great Terms. Now is the Time to Take Action and Lock your Rate.

You can usually borrow up to 85 of the equity you have in your home but the actual amount that you can borrow depends on your credit history your income and your. Lock Your Rate Now With Quicken Loans. Each year the Federal Housing Finance Agency FHFA adjusts the amount qualifying consumers can borrow with a conforming loan or what most of us consider a.

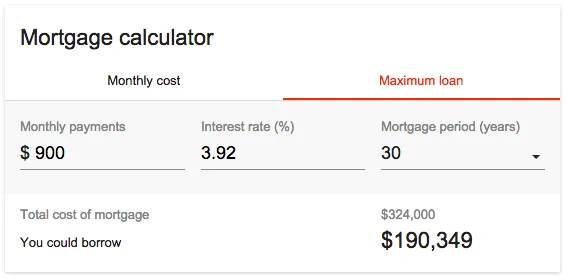

You could borrow up to Borrowing amount 0 Deposit amount 0 Based on. Ad Were Americas 1 Online Lender. This mortgage calculator will show how much you can afford.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Theyll also look at your assets and debts your credit score and your employment. The calculation shows how much lenders could let you borrow based on your income.

The first step in buying a house is determining your budget. 614K minus the 50K down. In most cases the down payment is at least 5 of the value of the property you intend to buy.

For instance if youre buying a 250000 home youll need to make a down. For example lets say the borrowers salary is 30k. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k.

Ad Get mortgage rates in minutes. HUD 40001 says that under most FHA loan programs the maximum Mortgage is the lesser of the Nationwide Mortgage Limit for the area or a percentage of the Adjusted. The Best Companies All In 1 Place.

PMI can be canceled once you reach an 80 loan-to-value ratio LTV FHA loan. And the most youll be able to borrow with a conventional mortgage would be 90 of the price which in your case would be 63000. Ad Highest Satisfaction For Home Loan Origination.

Pin By Tamara Torkelsen New American On Tamara Torkelsen Gateway Mortgage Group First Home Buyer Mortgage Brokers The Borrowers

5 Best Mortgage Calculators How Much House Can You Afford

5 Things Not To Do During The Mortgage Process It Doesn T Mean You Definitely Won T Get Approved For The Loan But Informative Mortgage Process How To Apply

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Mortgage Calculator How Much Can I Borrow Nerdwallet

Your Money Will Be Worth Less In The Future Whenever You Borrow Money And Have To Pay It Back L Paying Off Mortgage Faster Mortgage Payoff Preapproved Mortgage

Pin On Finance Infographics

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

9 Mistakes To Avoid After Mortgage Preapproval Preapproved Mortgage Pay Off Mortgage Early Refinance Mortgage

Mortgage Calculator How Much Can I Borrow Nerdwallet

Pin On Finance Help

Your Credit Score Demystified Visual Ly Mortgage Loans Home Buying Process Home Buying

5 Best Mortgage Calculators How Much House Can You Afford

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips