40+ Buying a second home mortgage calculator

Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing separately. Home Mortgage Tools Services.

Payment Schedule Template Excel Beautiful 8 Printable Amortization Schedule Templates Excel Template Amortization Schedule Schedule Templates Schedule Template

The average home price on the market here is 125553.

. Buying a home Mortgages help buying remortgaging first-time buyers. A mortgage calculator can help borrowers estimate their monthly mortgage. Bankrates compound interest calculator can help you determine the potential earnings on a money.

Mortgage loan basics Basic concepts and legal regulation. Bankrate compares thousands of financial institutions to make it easy for you to apply for the best certificate of deposit rate. The 3 stamp duty surcharge really adds to the finance required for buying a second home.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Across the United States 88 of home buyers finance their purchases with a mortgage. A fee of 100-300 for setting up maintaining and closing down your mortgage account.

However as a drawback expect it to come with a much higher interest rate. Fortunately KeyBank lets you borrow up to 90 percent of your homes value in a first and second mortgage if you qualify. This forecast expects home sales to slow down in the second and third quarters of 2022.

Again this does not include all of the 40-hour work weeks it will take you to pay for the down payment first mortgage and all of the upfront and ongoing costs that come with buying and owning a home. However you may wish to see yourself how the APR will vary if you make certain changes in the loan such as buying more or fewer points. Aside from the borrower their parents or family member also takes.

Approvals surged to 403 thousand in June 2020 as businesses began reopening. RBI hikes repo rate by 50 basis points to 490. There are several areas in the UK where the home buying market is currently affordable.

Mortgage interest relief has been capped at 20 which can impact you greatly should you choose to be a. This data is based on Housing Finance at a Glance. A mortgage is often a necessary part of buying a home but it can be difficult to understand what you can actually afford.

1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and student. Since its a short term its also a popular refinancing tool for homeowners. On widely expected lines the Reserve Bank of India RBI on June 8 2022 increased its short term lending rate the repo rate by 50 basis points as the countrys apex bank tries to bring down inflation from an eight-year-high levelThe six-member monetary policy committee voted unanimously in favour of the rate.

15-year FRMs are the second widely purchased home financing product in the US. Cumbria is ranked as one of the most affordable real estate markets as well as the happiest. Find the best CD rates by comparing national and local rates.

The amount you drive the purpose of the vehicle and how much you can afford to spend. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. On average a home goes for 205014.

30-year FRMs come with more affordable monthly payments than 15-year fixed loans. 100 percent mortgages are a type of guarantor mortgage geared toward buyers who cannot afford a home on their own. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

And the mortgage company explained that rising mortgage rates which are now at the highest level since the Great Recession 2008-2009 could have a domino effect softening construction activity and ultimately decelerating historically high housing. A Monthly Chartbook released in June 2020. An MMM-Recommended Bonus as of August 2021.

To decide if you should lease or buy your next vehicle you should consider three main factors. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. As a Canadian buying a home in the US you have some unique needs and probably lots of questions.

On the other hand the 30-year fixed-rate loan remains the most popular mortgage product in America. Ribble Valley is second on the list for affordability. Second home buyers can also avail of the discounted rates though they will also be required to pay an extra 3 stamp duty.

Estimate your monthly mortgage payment including taxes and insurance. 140 Minimum balance to open. AARP is the nations largest nonprofit nonpartisan organization dedicated to empowering Americans 50 and older to choose how they live as they age.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. With so much information out there it can be overwhelming for those who are unfamiliar with the home buying process. Average home price in the United States.

You can get a 025 percent rate discount if you have a KeyBank. As for 30-year fixed-rate mortgages Urban Institute reported that it. The median home sales price is 428700 as of the first quarter of 2022.

Half of American workers are quiet quitters Gallup finds Pandemic has frayed relationship between employees and bosses leading to greater disengagement at work survey suggests. It is the second most purchased type of mortgage product next to 30-year fixed-rate loans. You probably have heard of MRTA which stands for Mortgage Reducing Term Assurance and MLTA which is Mortgage Level Term Assurance.

We finance primary residences second homes and vacation homes up to 80 of the appraised value of the property which means you will need. Based on your entries this is how many 40-hour work weeks it will take you to just to pay the second mortgage interest charges. Use our Mortgage Affordability Calculator to estimate how much you can borrow based on your income and outgoings.

This mortgage finances the entire propertys cost which makes an appealing option. How to buy a house. When you are about to take out a home loan do take into consideration buying mortgage insurance too.

Thats a 30 increase from 2020 when the median was 329000. Buying a new home can be one of the most important purchasing decisions you can make. It will help protect your family from having to pay off your housing loan in case something unfortunate happens.

When it comes to home loans and housing rate assistance San Diego County Credit Union has you covered.

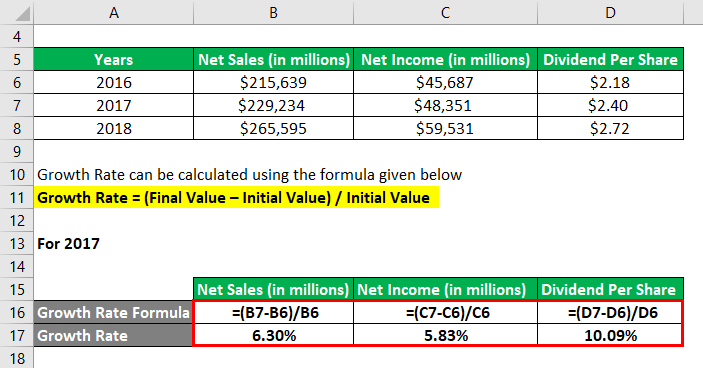

Growth Rate Formula Calculator Examples With Excel Template

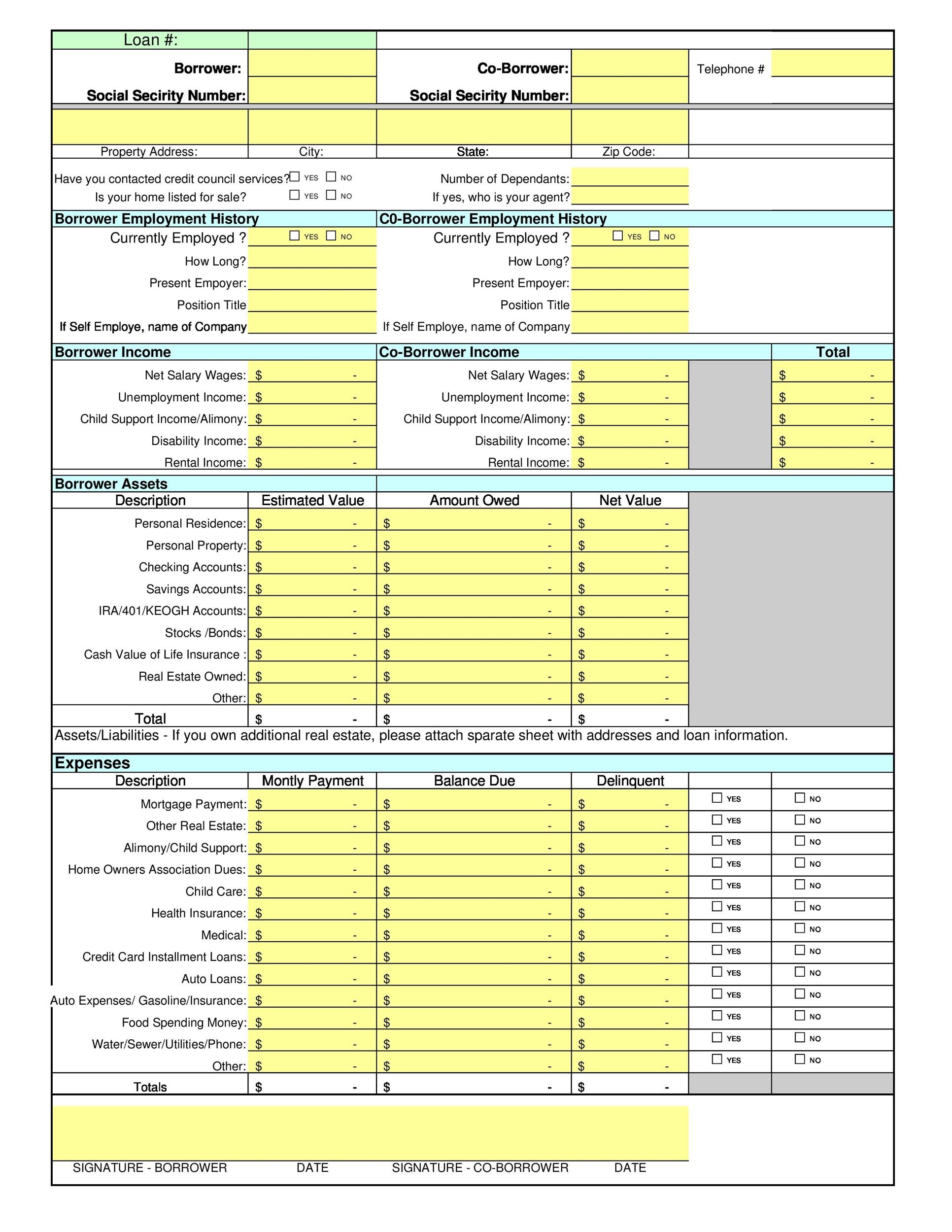

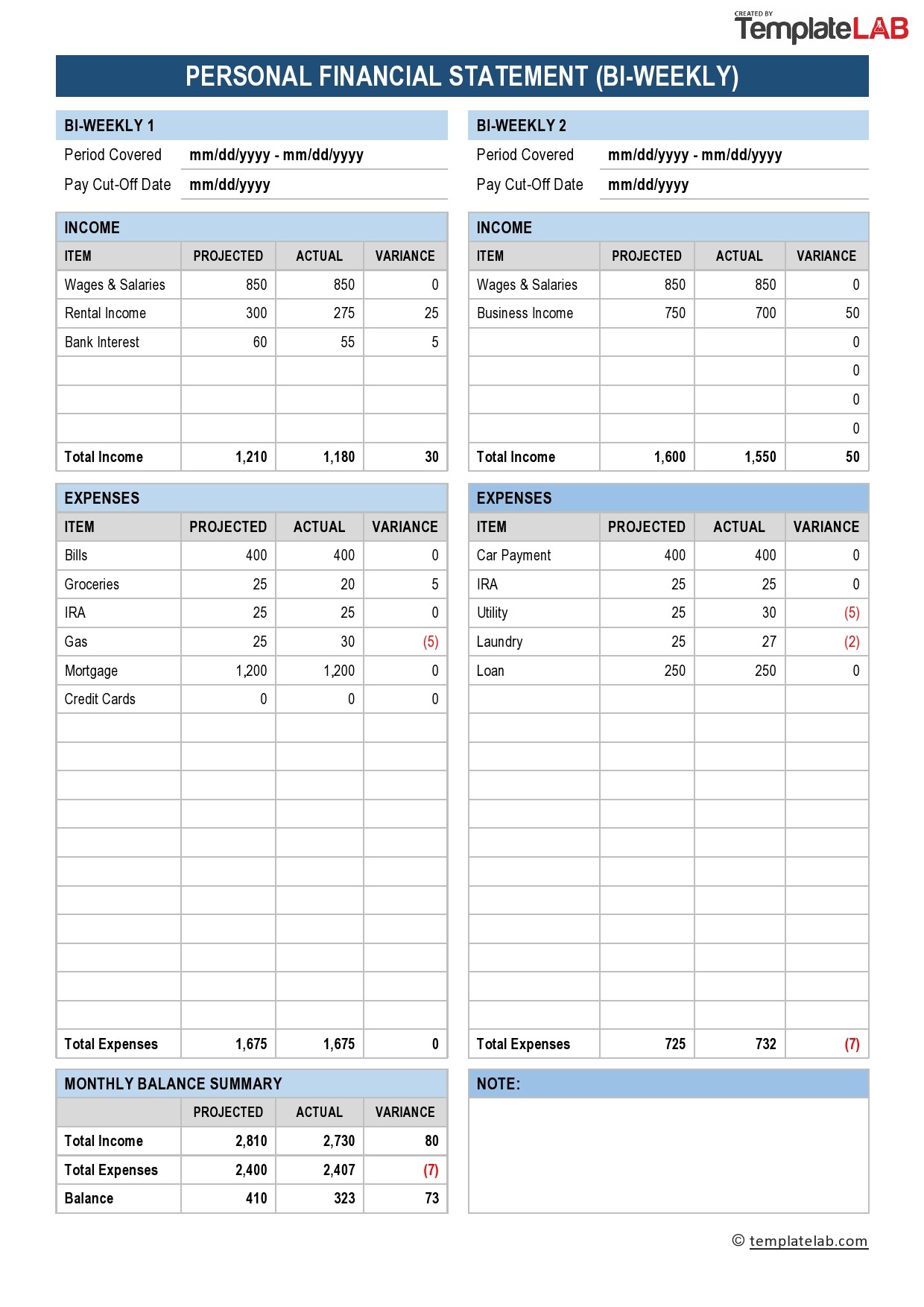

40 Personal Financial Statement Templates Forms ᐅ Templatelab

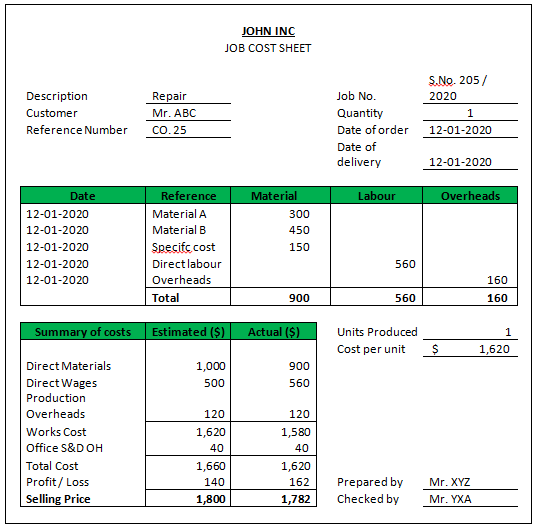

Job Costing Complete Guide On Job Costing In Detail

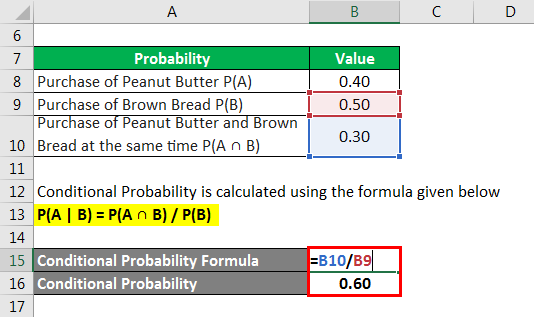

Conditional Probability Formula Example With Excel Template

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

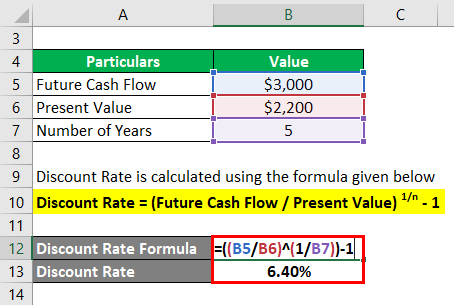

Discount Rate Formula How To Calculate Discount Rate With Examples

I Mean I M Most Likely Never Going To Own Property Get Married Have Kids Or Have Over 2000 In My Bank Account At Any Given Time So Yeah R Whitepeopletwitter

Interview 020 How To Have Your Cake And Eat It Too Choose Work You Love And Fire By 40 Nomad Numbers

I Make 15 An Hour I Work A 40 Hour Week How Much Do I Take Out For Taxes Since I M Self Employed Quora

Net Cash Flow Formula Calculator Examples With Excel Template

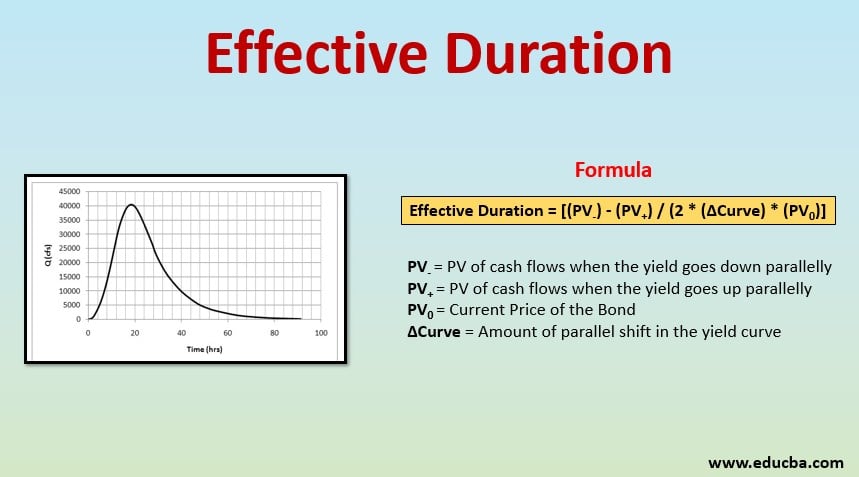

Effective Duration Formula How To Calculate Effective Duration

18 Sea Gate Avenue Westhampton Ny 11977 Mls 3420100 Trulia

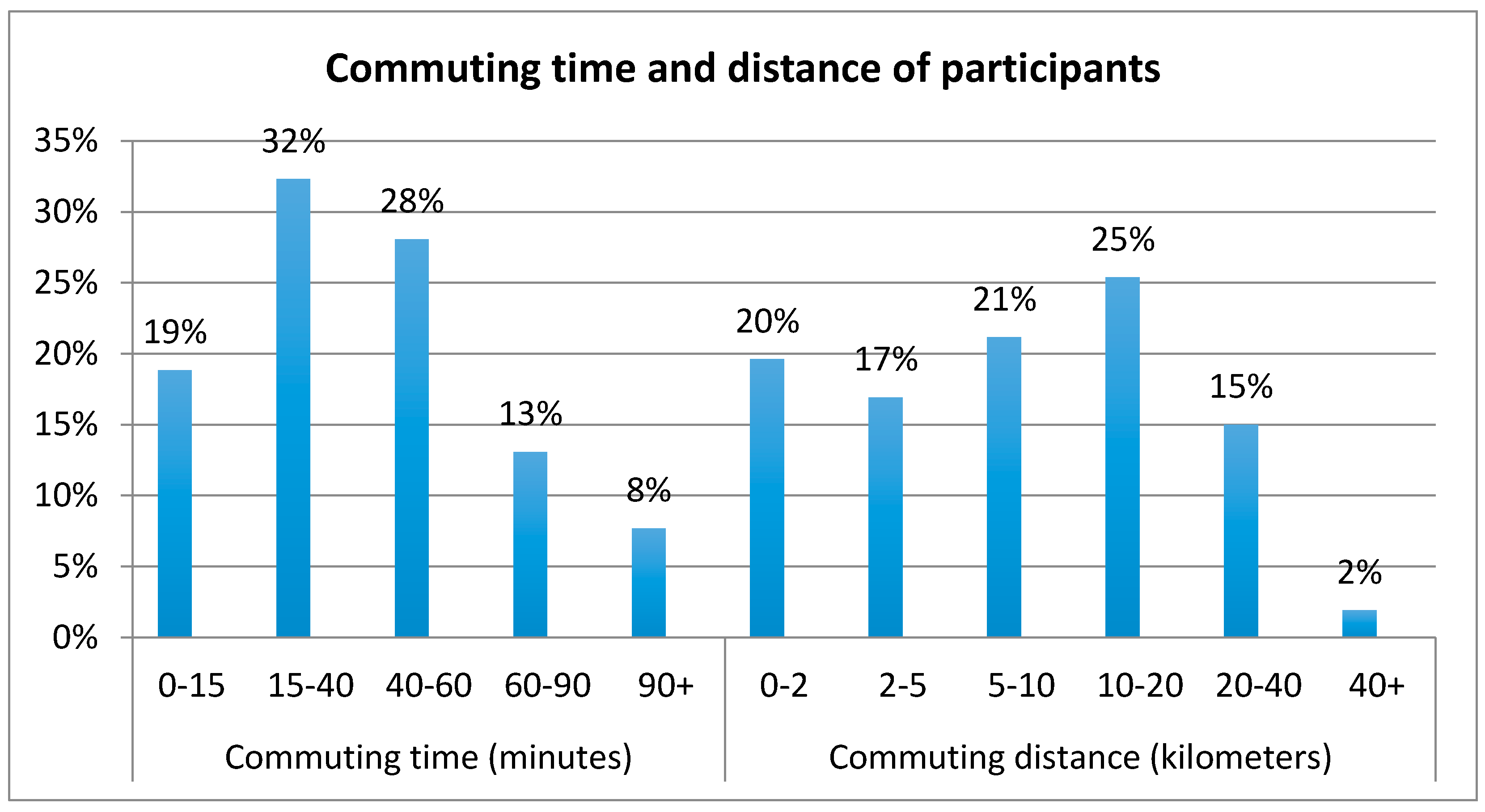

Urban Science Free Full Text Sharing And Riding How The Dockless Bike Sharing Scheme In China Shapes The City Html

How Much Savings Should I Have By 40 A Retirement Savings Guide

Fomc Realtor Com Economic Research

40 Personal Financial Statement Templates Forms ᐅ Templatelab

How Much Savings Should I Have By 40 A Retirement Savings Guide